Providing Reliable Insurance Solutions to Protect Your Business, Home, and Vehicles.

Andrew Hill Insurance Agency provides comprehensive coverage for your most valuable assets—your home, car, and essential appliances. Protecting what matters most is our priority.

ABOUT US

Your Trusted Insurance Partner

Founded by Andrew Hill, our agency began with a simple goal: to offer personalized insurance solutions with integrity and care. Over the years, we’ve grown alongside our clients, adapting to their evolving needs while staying true to our core values. Whether you're a new homeowner, a seasoned driver, or someone looking to protect their appliances, we’ve got you covered.

OUR SERVICES

We Also Offer

Auto Insurance

Protect yourself and your vehicle with our comprehensive auto insurance plans. We offer a variety of coverage options, including liability, collision, and comprehensive plans, ensuring that you're covered in the event of accidents, theft, or damage. Our policies also include uninsured and underinsured motorist coverage, giving you added peace of mind on the road. With flexible payment plans, 24/7 claims support, and discounts for insuring multiple vehicles, our auto insurance is designed to keep you and your loved ones safe wherever the journey takes you.

Home Insurance

Your home is more than just a building; it's where memories are made and cherished. Our home insurance policies provide robust protection against a wide range of risks, including fire, theft, and natural disasters. In addition to covering the structure of your home, we also protect your personal property and offer liability coverage to shield you from legal claims. With discounts available for security systems and other protective measures, our home insurance ensures your sanctuary is always safeguarded.

RV and Boat Insurance

Enjoy the freedom of the open road and open water with the assurance that you’re fully protected. Our RV and Boat Insurance policies are designed to cover the unique needs of recreational vehicle and boat owners, offering protection against physical damage, liability, and personal effects. Whether you're traveling in your RV or cruising on your boat, our plans provide the coverage you need in case of accidents, weather damage, or theft. With flexible coverage options and the potential for multi-policy discounts, you can embark on your adventures knowing that your investment is secure.

Commercial Insurance

Protect your business with comprehensive commercial insurance tailored to your unique needs. Whether you're a small startup or an established corporation, our commercial insurance solutions safeguard your assets, employees, and operations. From property and liability coverage to workers' compensation and specialized policies, we provide peace of mind so you can focus on growing your business. Someone on our expert team works with you to assess risks and ensure you're fully covered for every scenario. Explore customizable plans designed to protect what matters most in your business journey.

TESTIMONIALS

CUSTOMER REVIEWS

When I was involved in a car accident last year, I was overwhelmed and didn't know where to turn. That's when I realized the true value of Andrew Hill Insurance Agency. From the moment I called their 24/7 support line, I felt reassured.

Mike Honcho

Andrew made me feel relaxed and an ease when we first met. He was very informative and helpful in helping me get the best rate possible against my Allstate policy that I had. After several agent switches I knew it was time to find a great agent!-

Micheal Davis

OUR TEAM

John Doe

David Doe

Jane Doe

FAQS

What factors affect my auto insurance premium?

Your auto insurance premium is determined by a combination of factors, including your driving history, the type of coverage you select, the make and model of your vehicle, your location, and even your credit score. Safer drivers with clean records typically pay lower premiums, while high-risk drivers may face higher rates. The specific details can vary between insurance companies, so it's essential to discuss your unique circumstances with one of our experienced agents to get an accurate quote tailored to your needs.

Can I add additional drivers to my auto insurance policy?

Yes, you can usually add additional drivers to your auto insurance policy. This can include family members, friends, or other individuals who regularly drive your vehicle. However, it's essential to provide accurate information about all drivers and their driving history when adding them to your policy.Keep in mind that adding drivers with a poor driving record or a history of accidents may increase your insurance premium. Conversely, adding experienced, safe drivers can sometimes lead to lower rates.

What happens if I let someone borrow my car, and they have an accident?

If you lend your car to someone and they have an accident, typically your auto insurance policy would be the primary coverage in most cases. Insurance typically follows the car, not the driver. So, your insurance would likely be responsible for covering the damages to your vehicle and any liability associated with the accident.However, it's essential to check your policy and consult with your insurance provider because coverage can vary. Some policies may exclude certain drivers or have restrictions on who can use your vehicle. Additionally, if the person borrowing your car has their own auto insurance, their policy might provide secondary coverage.

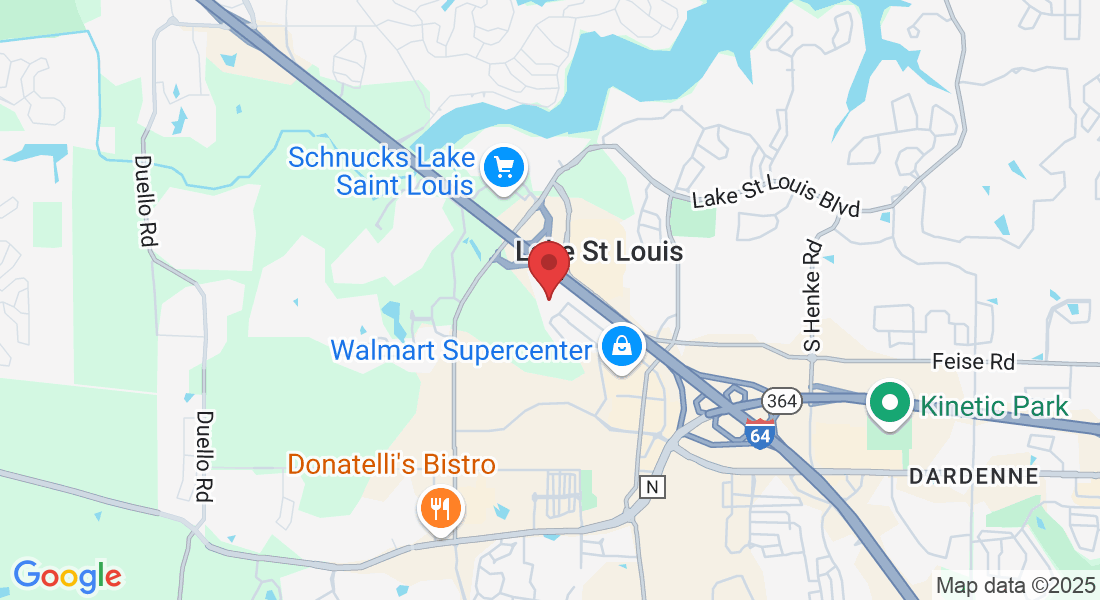

Get In Touch

Email: [email protected]

Address Office: 128 Sunglow Dr Saint Louis, Lake Saint Louis Missouri 63367

Assistance Hours:

Mon – Sat 9:00am

Sunday – 8:00pm

Email: [email protected]

Phone: 314-518-7471

Address Office:128 sunglow Dr, Lake Saint Louis, Missouri,63367